Why? Since many of the principal, specialized, and nostalgic markers that we intently track have hit limits as of late. In addition, when considering bear market fundamentals and buyer's markets, they may often be limited.

Furthermore, we found the most convincing of these markers.

A specialized marker streaked an "intense trepidation" signal the month before. This pointer has streaked this identical sign in excess of multiple times throughout the course of recent years.

Obviously, after we found this specialized pointer, we turned out to be more bullish than at any time in recent memory.

The heaviness of proof today unequivocally recommends that financial backers who contribute now will rake in boatloads of cash throughout the following year.

Here is a more profound look.

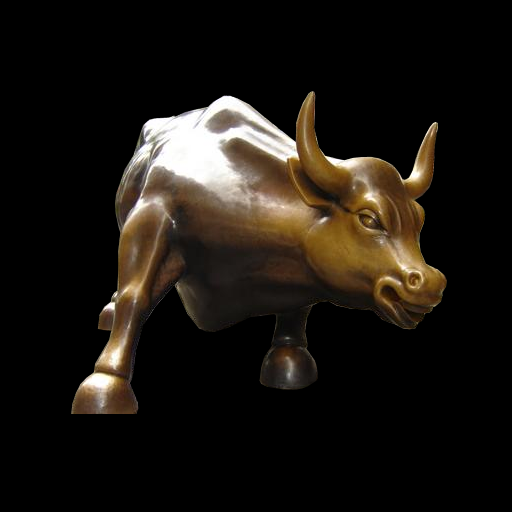

The Most Vulnerable Market Of all time?

The McClellan Oscillator is the specialized pointer we are alluding to.

In particular, the pointer estimates the contrast between the 19-and 39-day remarkable moving midpoints of net propelling shares. The lower the distinction, the smaller the market broadness.

That is a surprisingly frail MO perusing. It's probably essentially as frail as the perusing has at any point been. It addresses "top trepidation" and "pinnacle shortcomings" on the lookout.

For setting, this oscillator has dipped under - 15 several times before recording, which means that the oscillator recently spent 1.4% of its time on today's exchange day.

An Ideal History

The last time MO was this negative was the year before last, at the profundities of the Coronavirus pandemic.

What does such an extremely long time share, practically speaking? They were all extremely near an outright base after a financial exchange defeat.

As such, we found a specialized pointer with a 100 percent history of calling the base of the market and new positively trending market - and foreseeing enormous returns throughout the following year.

That is no joking matter.

New Crypto Buyer Market?

It progressively seems the market of crypto is managing a lining interaction at the present time. There's a lot of proof recommending such a lot.

Provided that this is true, it is unbelievable to be bullish because when the market becomes a positive trend market, the rate of return is the highest.

Obviously, before their next action, cryptologists are combining, and the plummeting McClellan oscillator is a huge data supporting our own. Also, we accept this moment as the opportunity to situate ourselves for "Blast Cycle 2023"!

Cryptos are a fence against cash printing and a significant gamble on the resource. Hence, cryptos will quite often function admirably when financial arrangement is slackening, and they will generally crash when money related approach is fixed. Money related approach has been fixed the entire year, consequently, the accident in cryptos. Yet, the macroeconomic trend began to turn - expansion is falling, markets are declining, monetary pressure is building, and so on - in a way that is strong of a Taken care of strategy turn. Fixing will transform into slackening sooner or later in 2023. Furthermore, reasonable at the principal clue of this likely turn, cryptos will take off and enter another blast cycle.

We turned out to be more persuaded by this proposition a month ago.

Why? Since Money Road Diary journalist Scratch Timiraos expounded on developing worries inside the Fed requiring a rate climb lull.

Conclusion

Therefore, we should be prepared for this precise bull market indicator rather than blindly investing. Pay attention to the market trend of cryptocurrency, and invest at an appropriate time to achieve your goals of financial freedom as soon as possible.