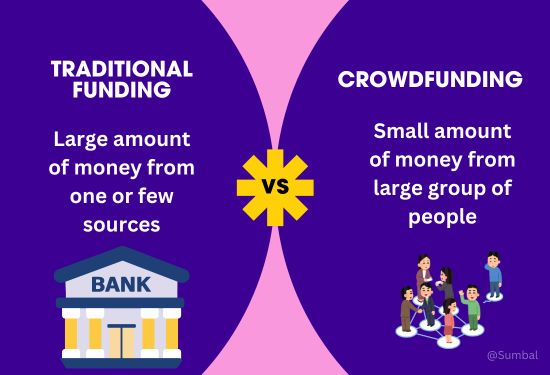

Of all the industry funding models, crowdfunding has received increased attention as an appropriate source of funding for start-up firms and other firms that may not be able to get funds from traditional sources like banks. Besides being an alternative source of financing, crowdfunding facilitates idea testing, customer acquisition, and building excitement around a product or a service.

How Crowdfunding Works

Crowdfunding usually entails putting a business idea online and having people invest their money. There are four main types of crowdfunding:

Reward-Based Crowdfunding

Contributors are given a product, service, or incentive in exchange for helping with the course. This is a usual practice on Kickstarter and Indiegogo, where startups can offer early bird rewards.

Equity Crowdfunding

In this model, investors are offered a small fraction of the company's equity. Equity crowdfunding is common in SeedInvest and Crowdcube, where people invest and receive shares in a start-up company.

Donation-Based Crowdfunding

For the most part, charitable crowdfunding is aimed at initiatives with funding being raised through the support of people who would not personally receive any profit from the project. While not as frequent for startups, this model could benefit companies with a social mission.

Debt Crowdfunding

The other, known as peer-to-peer lending, involves lending money to various startups in the hope of being paid back with interest. Such possibilities can be found on sites like LendingClub and Funding Circle.

Crowdfunding's Advantages for Startups

Obtaining Capital

Crowdfunding provides funding to startup businesses that cannot access loans or venture capital. It allows owners to obtain money from more people and mobilize those who believe in their initiatives.

Market Validation

Through crowdfunding, startups can determine whether people will buy services or products by investing in them first. A good campaign proves consumers’ interest in a product, which can be a perfect signal for future investors.

Community Building

Crowdfunding promotes direct relationships with potential buyers and supporters. People who contribute are also able to promote the brand, helping to get the word out and create more demand. It also has a loyal customer base before even launching a business.

Reduced Dependence on Traditional Funding

Crowdfunding presents an opportunity for startups that may fail to access venture capital or bank loans. Corporate funding by various individuals lacks the criterion characteristics of outside interference; business owners are able to seek funds to support their businesses from individuals other than taking a financial hit or going through debts.

Challenges of Crowdfunding

In an environment where thousands, if not millions, of campaigns run simultaneously, it can be challenging to stand out. Marketing is one of the most crucial things a company should spend time and money on in order to find potential investors. A well-crafted pitch, a captivating and engaging video, and thoughtfully thought-out social media activity are all necessary for visibility.

The campaign may not achieve its funding goal, and depending on the platform's rules, the startup may get no funds. This means that even after conducting a successful campaign, adequate funding may not be realized, thus resulting in gaps in funding.

When the campaign promises incentives, fulfilling them on time and meeting the backers' expectations can be challenging. The inability to perform the task to the expected standard has negative impacts; the brand's essence is compromised, leaving consumers with no confidence in the product.

Laws and regulations pertaining to equity crowdfunding vary from one nation to the next. Applying these rules may also take some time and advice from a professional and add an extra cost to the startup.