With the ever-growing role of financial transactions shifting to the online environment, biometric authentication is increasingly becoming a common and secure method of identity verification. Using features such as fingerprints, faces, and voices, biometrics are gradually replacing password-and-PIN protection mechanisms. However, is there a future in this technology, and what does the future portend for managing such financial processes?

The Growing Role of Biometric Authentication

The general concept of biometric authentication is highly secure compared to other traditional ways of authentication. Unlike passwords that can be hacked or guessed, biometrics are based on human physical attributes and thus are very safe. Today, biometric technology is employed for mobile banking, payment processing, and ATMs, among other things. In other cases, like Apple Pay or Google Pay, security features include fingerprint or facial recognition in digital wallets.

Types of Biometric Methods

A range of biometric methods are being included by financial services:

- Fast fingerprint recognition can be found on smartphones and mobile apps.

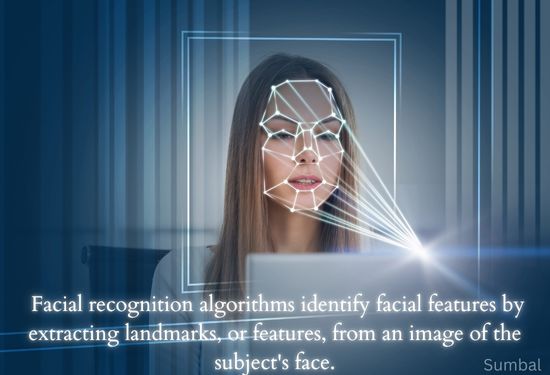

- Facial Recognition is contactless, and it is being adopted more rapidly worldwide in areas like online banking and payment verification.

- Voice recognition is an effective tool for identity proofing in customer service centers that take orders.

- Iris and Retina Scanning methods are relatively rare but are highly secure and frequently used in increased security areas.

Advantages and Difficulties

Additionally, it offers more protection and keeps fraud from accessing the account because it uses biometric authentication. However, at the same time, it is an issue of confidentiality and protection of data as its keeper. After biometric data has been violated, there is no way of resetting it like a password. Furthermore, proper biometric data management is essential because any leakage can cause significant harm to the users.

Another is the problem of privacy. Biometric data is very sensitive, and users want to be sure that it will not be used inappropriately. Thus, protective legislation is currently being adopted around the globe regarding biometric information.

Emerging Trends

Several trends indicate where biometric authentication is headed:

- Multi-factor biometrics enhances security; the systems use multiple biometric identification, such as fingerprint scanning and voice recognition.

- Behavioral Biometrics methods also consider user activity, such as typing speed or phone use, for extra protection.

- Wearable Biometrics wearables such as smartwatches, for example, have biometric sensing in their present form, which may serve payment and access control in the future.

The Role of Fintech and Traditional Banks

Since then, fintech companies have quickly embraced biometrics to increase service security and efficiency. In response, traditional banks also employ biometric technology to counteract digital organisations. Shifts suggest biometrics will become central to financial technology and conventional banking systems.

Conclusion

In biometric authentication, individual analysis of financial transactions is expected to take a new dimension as biometrics provide a security and convenience factor that is difficult to match. But like any other technology, some concerns in privacy and data protection need to be encountered to gain users' trust. In the future, biometrics will remain a part of financial industries, constantly evolving to represent security in the future world.